Photo by Darren Irvin on Unsplash

It finally happened, The legislation that Plano has been threatening they would be pursuing has finally been filed.

The following article can be pretty wonky, if you're into municipal finance and public administration you’ll be right at home but here’s a quick summary for everyone else. This bill is bad, it diverts 25% of DART's revenue so that it can only be used for Road and sidewalk maintenance, and then it sets up additional restrictions to eventually force DART to lower its tax rate from 1% to .75%. That’s a 44% reduction after everything is implemented. It would definitely destroy the ability of DART to maintain its current operations, let alone improve service. This bill will put DART on life support, throwing away all of the hard work DART is doing to improve and tailor their services to the cities. This was done without holding an election by the citizens of the service area.

Background - What is a bond?

A bond is like a little piece of a loan, when a governmental entity like DART has a big project they want to build (like say a 27-mile suburban commuter rail line) they probably don’t have the cash on hand to pay for it all at once. They need to get a loan to spread out the cost because it would take a LONG time to save up all the money needed.

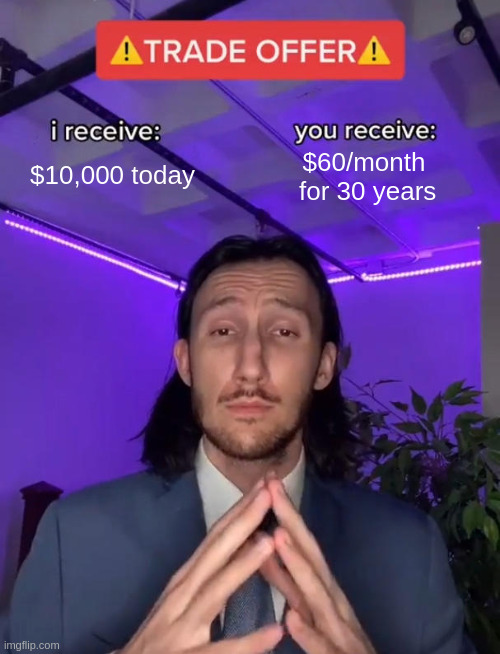

Fig. 1 - This is an overly simplistic example, in reality the bond holder might only get interest payment monthly or quarterly, or just a large lump sum at when the bond reaches maturity. Those details are not important for this discussion.

Fig. 1 - This is an overly simplistic example, in reality the bond holder might only get interest payment monthly or quarterly, or just a large lump sum at when the bond reaches maturity. Those details are not important for this discussion.

DART issues a particular type of bond called a Sales Tax Revenue Bonds. Instead of putting up a piece of collateral (like you would with a mortgage) these bonds are secured by future sales tax revenues

Underlying each bond is an agreement, a contract. This contract lays out the nitty gritty details on how interest is calculated, how the administrative cost of the bonds are paid for, when are payments made, what happens if DART should default, the process for appointing a representative of the bound holders, and much more. If you’re curious you can try and wade through the entire 66 page document, but it's pretty dry, and probably won’t make much sense unless you're a lawyer or banker.

There is one section that is important to know (thank you to David Leininger, former CFO of DART for bringing this to the public's attention in a post on linkedIn)

Section 2.2 (b) For so long as any Obligations are Outstanding or unpaid, or any Administrative Expenses are due, payable, and unpaid, DART covenants and agrees that (i) the Sales Tax at said rate, or at a higher rate if permitted by Applicable Law and subject to any applicable requirements for an election under the Voted Tax and Debt Limits, will be levied and collected continuously, in the manner and to the maximum extent permitted by Applicable Law; and (ii) the Board will not order any reduction in the rate of tax below the rate stated, confirmed and ordered in subsection (a) of this Section.

Basically what this saying is, as long as there is an outstanding bond, DART will not lower its tax rate. Another important fact to know is this section of the Texas Constitution (emphasis added)

Article 1. Bill of Rights: Sec. 16. BILLS OF ATTAINDER; EX POST FACTO OR RETROACTIVE LAWS; IMPAIRING OBLIGATION OF CONTRACTS.

No bill of attainder, ex post facto law, retroactive law, or any law impairing the obligation of contracts, shall be made.

Together this means the State can't come in and pass a law forcing DART to lower its tax rate when it has already obligated its self to maintain that tax rate for its bondholders.

How to read a bill

Legislation is hard to read! The law is complicated, full of jargon, terms of art, big concepts, and bills are written to only show the changes they are making, so you can lose a lot of context of what's in the rest of the legal code.

Here’s a video that goes through some of the pitfalls of trying to understand a piece of legislation. How to Decipher State Legislation Like a Proper Gentleman

Section by Section Summary

Section 1.

Subchapter E, Chapter 452, Transportation Code, is amended by adding Section 452.204 to read as follows:

** Sec. 452.204. GENERAL MOBILITY PROGRAM. (a) Each municipality in an authority consisting of one subregion governed by a subregional board created under Subchapter O shall enter into an agreement with the subregional board under which up to 25 percent of the sales and use tax imposed by the authority in that municipality may be used by that municipality for a general mobility program that includes:

(1) constructing and maintaining sidewalks, hiking trails, and biking trails, highways and local and arterial streets, thoroughfares, and other roads, including bridges and grade separations;

(2) installing, operating, and maintaining streetlights and traffic control improvements, including traffic signals; or

(3) making drainage improvements and taking drainage-related measures as reasonable and necessary for the effective use of the transportation facility being installed, constructed, operated, or maintained under Subdivision (1) or (2).

(b) Under an agreement entered into under Subsection (a), a municipality shall annually provide to the subregional board a list of projects the municipality intends to fund through the program.

(c) Of the sales and use tax available to a municipality through the general mobility program each year:

(1) 50 percent shall be made available to the municipality on the first day of the authority's fiscal year; and

(2) 50 percent shall be made available to the municipality on a reimbursement basis before the end of the authority's fiscal year.

(d) Any money made available to a municipality under Subsection (c) that is unused by the municipality in the period described by that subsection must be used by the authority to pay down any outstanding debt that is secured by a sales and use tax rate imposed at a rate of one percent. A payment made under this subsection is in addition to any annual debt payment required of the authority.

Alright what the heck does all of that mean? Basically it creates a new section 452.204 that establishes a “General Mobility Program” for each member city

- Diverts 25% of sales tax revenue for Subchapter O Transit authorities (DART is the only Subchapter O authority in the state)

- Can only be used for Roads, Traffic Signals, Sidewalks, or drainage projects i.e Not transit

- Half made available at the beginning of the FY, Half available on a reimbursement basis

- The city must submit a list of projects they plan to use the funds for each year

- Unused funds go into a trust for additional debt payments on top of regularly scheduled bond payments

Section 2.

Section 452.357(a), Transportation Code, is amended to read as follows:

(a) To secure the payment of an authority's bonds, the authority may:

(1) pledge not more than 75 percent [ ~all or part~ ] of revenue realized from any tax that the authority may impose;

(2) pledge any part of the revenue of the public transportation system;

(3) mortgage any part of the public transportation system, including any part of the system subsequently acquired;

(4) pledge all or part of funds the federal government

has committed to the authority as grants in aid; and

(5) provide that a pledge of revenue described by Subdivision (1) or (2) is a first lien or charge against that revenue.

Amends Section 452.357(a) to change the amount of revenue that can be pledged towards bond from “all or part” to “not more than 75 percent”

Section 3.

Section 452.358, Transportation Code, is amended to read as follows: Sec. 452.358. USE OF REVENUE. Revenue in excess of amounts

pledged under Section 452.357(a)(1) or (2) shall be used to:

(1) pay the expenses of operation and maintenance of a

public transportation system, including salaries, labor,

materials, and repairs necessary to provide efficient service and

every other proper item of expense; [ ~and~ ]

(2) fund operating reserves; and

(3) fund a general mobility program established under

Section 452.204.

This section simply adds the GENERAL MOBILITY PROGRAM as an allowed used of 452 sales tax funds, and importantly makes the Mobility program a lower priority than bond payments.

Section 4.

Section 452.401(a), Transportation Code, is

amended to read as follows:

(a) The executive committee may impose for an authority a sales and use tax at the rate of:

(1) one-quarter of one percent;

(2) one-half of one percent; or

(3) three-quarters of one percent [ ~; or~ ]

[ ~(4) one percent~ ]

This section amends Section 452.491(a) to remove “one percent” as an allowed sales and use tax rate. On its face this make look like blowing up DART's bond convents, remember this for when we get to section 8.

Section 5.

Section 452.651(c), Transportation Code, is

amended to read as follows:

(c) An election to withdraw may not be ordered, and a

petition for an election to withdraw may not be accepted for filing,

more frequently than once during each period of 12 months preceding

the anniversary of the date of the election confirming the

authority. If the unit of election is located in an authority

consisting of one subregion governed by a subregional board created

under Subchapter O, an election for withdrawal of the unit of

election under this section may not be ordered, and a petition for

withdrawal may not be accepted, more frequently than once during

1996 and during each third [ ~sixth~ ] calendar year after that year.

Changes the frequency of withdrawal election from being allowed every sixth year to every third year

Section 6.

Subchapter Q, Chapter 452, Transportation Code,

is amended by adding Section 452.6545 to read as follows:

Sec. 452.6545. EFFECT OF NOTICE OF ELECTION ON CERTAIN

AUTHORITY TO ISSUE OBLIGATIONS. Notwithstanding Subchapter H, on

receipt by the executive committee of the authority of a notice

provided under Section 452.655(c), the authority may not issue

notes, bonds, or other obligations if the issuance would cause the

financial obligation of the unit of election under Section

452.659(a) to accrue because the amount in Section 452.659(b)(3)

would increase. This limitation on issuance continues until:

(1) the effective date of the withdrawal of the unit of

election from the authority, if after an election held under

Section 452.655 less than a majority of the votes received on the

measure in the election favor the proposition; or

(2) the day after the date of the canvass of an

election held under Section 452.655, if a majority of the votes

received on the measure in the election favor the proposition.

This new section prohibits a city from taking on new debt while a withdrawal election is pending at that city. This would prevent DART from taking on debt for system-wide improvements or additions.

Section 7.

Section 452.658(a), Transportation Code, is

amended to read as follows:

(a) Until the amount of revenue from an authority's sales

and use tax collected in a withdrawn unit of election after the

effective date of withdrawal and paid to the authority equals the

total financial obligation of the unit, the sales and use tax

continues to be collected in the territory of the election unit at

the rate:

(1) at which the tax was imposed; or

(2) of one-half of one percent if:

(A) the tax was imposed at the rate of one

percent; and (B) the governing body of the withdrawn unit of

election approves the collection of the tax at the lower rate.*

This Section allows the city council of a withdrawn city to lower the tax rate to one-half of one percent. On its face this would violate DART's current bond covenants, but this bill has some mitigations in the next section.

Section 8.

(a)Sections 452.357(a) and 452.401(a),

Transportation Code, as amended by this Act, do not apply to the

imposition of a sales and use tax in a regional transportation

authority that, before the effective date of this Act, has pledged

the revenue from the tax imposed at the rate of one percent as

security for bonds issued by the authority. The imposition of a

sales and use tax in a regional transportation authority that has

pledged the revenue from the tax imposed at the rate of one percent

as security for bonds issued by the authority before the effective

date of this Act is governed by the law in effect when the revenue

was pledged, and that law is continued in effect for that purpose.

(b) The executive committee of a regional transportation

authority may, under Section 452.405, Transportation Code, order

the decrease in the rate at which a sales and use tax is collected in

an authority described by Subsection (a) of this section only

after:

(1) all of the bonds and interest on the bonds that are

payable from or secured by a sales and use tax imposed at the rate of

one percent have been paid by the issuer of the bonds or another

person with the consent or approval of the issuer; or

(2) a sufficient amount for the payment of all bonds

and interest on the bonds to maturity has been set aside by the

issuer of the bonds or another person with the consent or approval

of the issuer in a trust fund held for the benefit of the

bondholders.

Alright this is the really complicated one. This section is all about not violating DART's current debt covenants and destroying the state's bond rating. It's broken into two subsections a and b.

Subsection a basically says that the amendments to sections 452.357(a) and 452.401(a) do not apply to bonds that 1) have already been issued before the effective date of the bill and 2) have the full one percent sales tax pledged to them.

Subsection b says the agency can reduce its tax rate if 1) all of the bonds pledged at one percent have been paid off OR 2) enough money to pay off the remaining balance is saved in a trust account (remember those unused General Mobility funds? This is where those go)

Analysis

In my view this bill has 3 goals:

- Give 25% back to the member cities immediately to be used for road maintenance

- Impose restrictions so that DART's tax rate will eventually be reduced to .75%

- Make it easier to withdraw from DART, and make that withdrawal less painful

Now it's important to remember what this bill does not do. It does not lower tax rates. Any reduction in DART's tax rate will not go into the pockets of taxpayers, cities will immediately move to increase their sales tax rate if the rate is reduced to .75%. This bill is about changing who gets the money, and Plano wants to take over 40% of DART's funding.(The .25% Sales Tax reduction and the 25% Sales Tax Revenue for the mobility program stack, and works out to an effect 44% revenue reduction)

This bill is about Plano raiding DART for money to pay for their road and street maintenance. They told us as much in their Mayor’s letter to the Chair of the DART board last year. Notably Plano is proposing to issue over $400 million in road maintenance bonds over the next 4 years, while at the same time having adopted the “no new revenue” property tax rate for the last 4 years in a row. If Plano needs more money to pay for their roads they have mechanisms to do that without tearing apart DART. They can either raise their property taxes modestly or they can call an election to withdraw from the agency.

Importantly, this bill affects ALL of the member cities. The 25% General Mobility fund CAN NOT be used to fund transit operation regardless of the wishes of every other member city, and this restriction persists beyond when DART's current 1% pledged bonds are extinguished." In 1983 voters in every DART member city decided to dedicate a 1% sales to build a public transit system for the entire region, and they reaffirmed that vision in 2000 by authorizing DART to issue long term bonds for the construction and maintenance of its Light Rail system, the 2nd largest such system in the state. To have the state come in and decimate DART's ability to operate the system we have invested Billions of dollars to build would be fiscally irresponsible.

It's hard to overstate how bad this bill is. What organization can you think of that can lose over 40% of its funding (or even just 20%) and provide anywhere near the same level of service? And to try and do this on the eve of the suburban focused Silver Line opening? It's unconscionable, many member cities have been quite patient in waiting for their turn to get rail service, this bill will cripple that service as well as all of DART's other existing services.

Call to action

Alright so what do we do now?

We need you to contact your representatives. Call or Email them and let them know you Oppose House Bill 3187. Let them know that you don't want DART's funding reduced by 44% and that this is a local issue that Plano and DART need to work out among themselves.

DATA will be monitoring this bill very closely as it works its way through the legislative process.

References

- Leininger, David “The Plano v DART dilemma: pullout one city versus pulldown everyone” https://www.linkedin.com/pulse/plano-v-dart-dilemma-pullout-one-city-versus-pulldown-david-leininger-fmooc/

- DART Master Debt Resolution https://www.dartbonds.org/dart-investor-relations-tx/documents/view-file/i1016?mediaId=32701

- Mayor Mun's letter to Gary Slagel https://dallasareatransitalliance.org/assets/blog/data-statement-plano-ila/jbm-to-gary-slagel-dart-12-13-2024.pdf